Manage payment matters of an account (prepaid account)

If you are referring to payment of a Postpaid account, click here.

Want to learn the difference between prepaid and postpaid? Click here.

Go to Customer App > find the customer account > View > Payment:

1. Credits:

1. Credits:

Note:

- Red Number = negative amount (e.g: -1)

- Green Number = positive amount (e.g: 1)

You are able to:

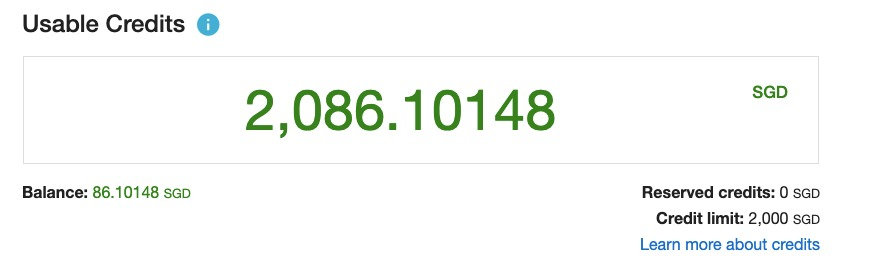

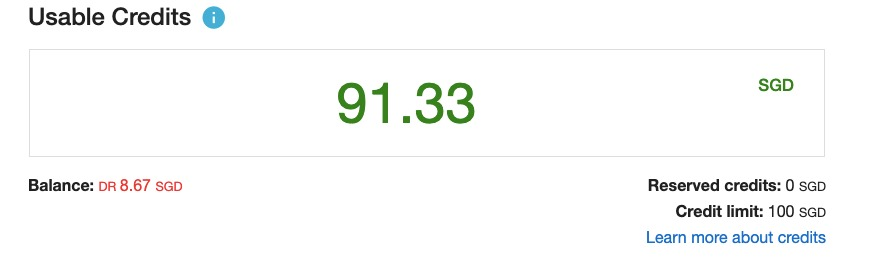

- See how many credits the account has:

- Usable Credits: the available amount that a customer can spend, inclusive of the credit limit

- If the usable credits are higher than the credit limit (2086.10148 > 2000), it means that the customer has not touched the credit limit yet.

- If the usable creditsare less than the credit limit (91.33 < 100), it means that the customer is using the credit limit. The amount being consumed is ~ 8.67).

- Usable credits are used for:

- Usage (call, sms, dnc)

- Subscription charge (purchase, renew, extend)

- If the usable credits are higher than the credit limit (2086.10148 > 2000), it means that the customer has not touched the credit limit yet.

- Credit limit: the maximum amount of credit a financial institution extends to a client. It can be set temporarily or permanently.

- Balance: the amount stored in this wallet.

- Balance = Usable credits - Credit Limit

- Reserved credits are caused by an ongoing transaction. If the transaction is successful, Reserved creditwill be deducted; otherwise, they will be returned to the Usable credits.

- Usable Credits: the available amount that a customer can spend, inclusive of the credit limit

2. Other Information:

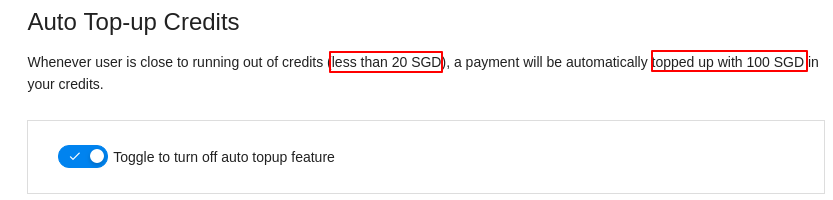

- View and adjust auto top-up settings (on behalf of your customer):

- Last time top-up amount: $100.

- Threshold to trigger top-up: $20 (20% of last top-up amount).

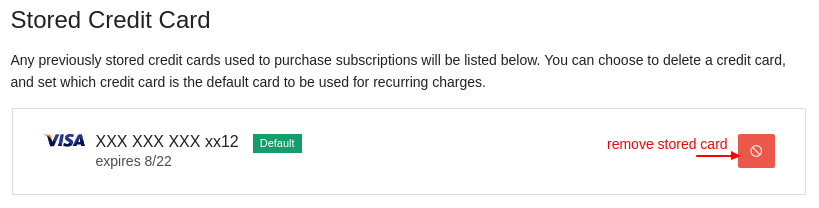

- View and adjust auto subscription renewal settings using the stored card (on behalf of your customer):

- View current payment method using to top up credits:

- View and remove stored credit card (if any):